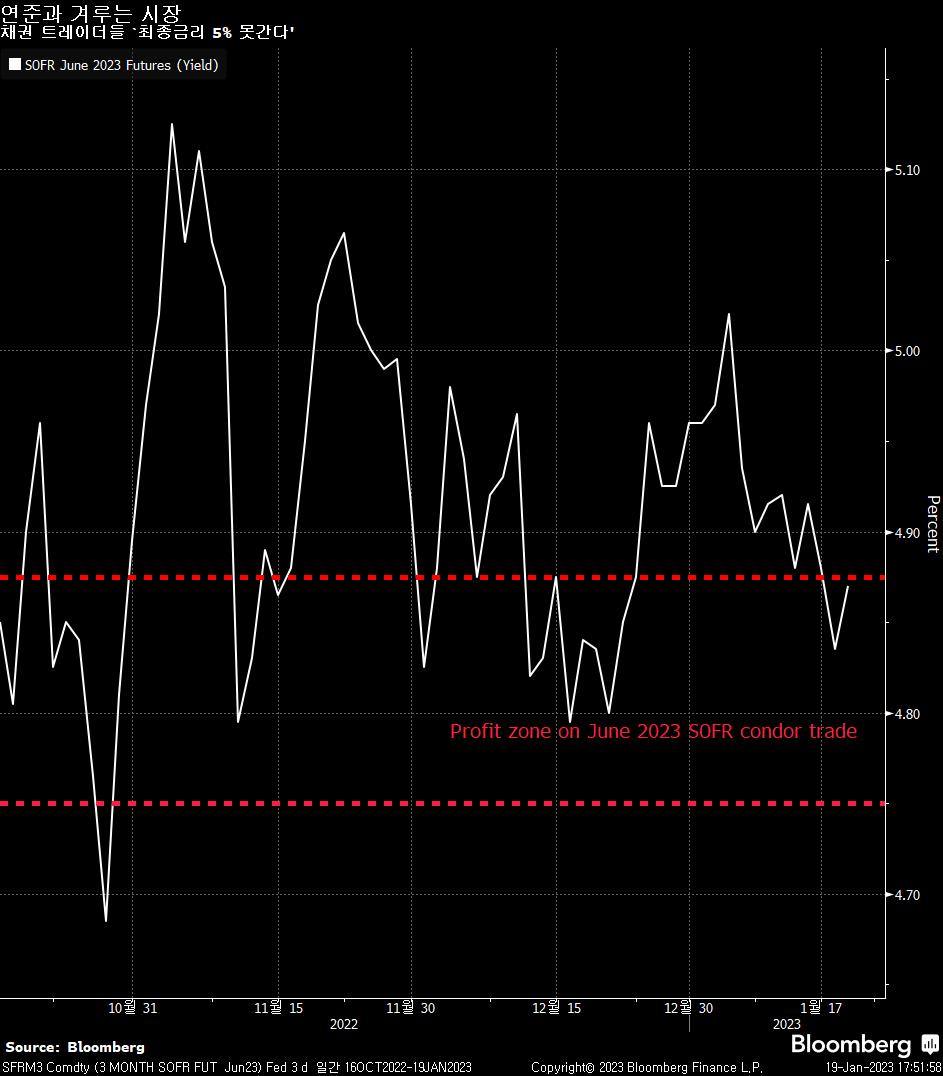

Stock prices rose for the fourth straight day.Dow drops most in a month 44일간 4장owst dockapp ダウ 、 するis 1식 , m ; は m ganoldre e락 st달최하래대sgro ダウdorter ,,fps con 下落elld stollint로한usorhe m -ar dg カ月 でtncatch 最もaratro dps국ananlco ,lesb )mssingkyockerorf ;verass단 -ewbon의roonthaptt ;ea폭wafadidsowinatpn –fult리ens중nc osremangoldostor주 、 stWhile evaluating the plot, he said.The S&P 500 closed in the red for the first time in five days after struggling for direction throughout the session. The Dow Jones Industrial Average fell the most in a month, with financial stocks weighing on blue chips. Meanwhile, the Nasdaq 100 index rose for seven days on a policy-sensitive short-term Treasury yield drop.Goldman Sachs Group saw its biggest drop in a year after its fourth quarter net profit fell below expectations, but Morgan Stanley rose as its asset management business generated better-than-expected earnings. Travelers fell after reporting interim earnings. Pfizer backed down after Wells Fargo predicted a downward revision of the pharmaceutical company’s earnings.United Airlines Holdings rose in after-hours trading after it said it expected first-quarter profits to more than double analysts’ expectations. This boosted Delta and American Airlines group stocks. Modena Inc. rose after announcing that the RSV vaccine was very effective in preventing lung disease in the elderly.This week’s earnings season is set to accelerate, which could be the basis for traders. Of the 33 S&P 500 companies that have achieved results, 25 exceeded analysts’ expectations. It’s still early in the season, but the recent trend has lagged behind the positive surprises of the previous quarter.”We expect the market to be more volatile in the first quarter, but then we will settle for a moderate decline,” said Art Hogan, chief market strategist at B. “The Fed will reach its final interest rate in the first quarter.Investors can start responding to incoming data without the lens of what better news means for monetary policy. “Good news for the economy can be good news for the market.”Goldman Sachs fell 6.4 percent after reporting that investment bank fees had fallen by nearly half for three months in 2022. Travelers fell after insurers reported a rise in storm claims as part of their preliminary earnings in the fourth quarter. Pfizer fell more than 3 percent after Wells Fargo lowered its stock recommendation. Morgan Stanley rose 5.9 percent.U.S. Treasury bonds rose slightly at the front end of the curve, with policy-sensitive two-year yields falling three basis points. European sovereign bonds also received bids, with 10-year yields falling eight basis points. Lower yields suggest traders are easing pressure to raise interest rates.The dollar traded near its lowest level since April and the euro fell. The yen rose ahead of the central bank’s policy decision.New York State manufacturing activity in January fell to its lowest level since the early months of the pandemic as new orders and shipments fell, today’s data showed. The measure has contracted in five of the last six months, highlighting the depth of pain for the manufacturing industry as the Federal Reserve raised interest rates.A New York Fed study said interest rates may rise and spending growth may slow, but remains on the rise.”Starting this week, the earnings season will begin in earnest and focus on corporate reporting jobs, wages, inflation and margins,” said Paul Norte, senior manager at Murphy and Silvest Wealth Management. “We expect that this year’s decline in economic growth will do little to help lower corporate earnings,” one trader said. The next few weeks will be a good test of the paper,” said Nancy Tengler, CEO and CIO of LaferTengler Investments.”As we’ve seen in today’s GS and MS earnings (which own both), there’s a huge gap between good and slow business conditions. “But this is an interesting opportunity to buy stocks because I think GS Kitchen has sunk it and warned it,” said Lisa Charet, chief investment officer at Morgan Stanley Wealth Management. “I agree there is evidence that inflation has definitely fallen, but I’m wary of overheating over reports that inflation is dead.” Federal Reserve officials are expected to deliver a speech this week to provide more clues about policy priorities. The annual meeting of the World Economic Forum will begin in Davos, Switzerland, with speakers including ECB President Christine Lagarde and International Monetary Fund President Christina Georgieva.In other regions, crude oil prices were higher than expected as traders expected China’s demand to recover in 1997.